Eylea Biosimilar Pavblu Enters Crowded Market With Some Uncertainty

Reprinted with AIS Health permission from the November 2024 issue of Radar on Specialty Pharmacy

The first biosimilar of Regeneron Pharmaceuticals, Inc.’s Eylea (aflibercept) recently hit the U.S. market when Amgen Inc. launched Pavblu (aflibercept-ayyh). The drug is entering a crowded class that includes a compounded drug used off-label, as well as a high-dose formulation of Eylea. But it’s unclear how much both agents may be used going forward.

A compounded formulation of Roche Group unit Genentech USA, Inc.’s Avastin (bevacizumab) is the least expensive option within the class. It has undergone clinical trials supporting its use in eye disorders, but Genentech has not applied for approval of the indications. For ocular use, it costs about $50 per injection compared with around $1,500 to $2,000 for the other treatments.

However, the American Academy of Ophthalmology (AAO) and the American Society of Retina Specialists (ASRS) revealed on Oct. 16 that the largest supplier of compounded Avastin, Pine Pharmaceuticals, is discontinuing its manufacturing of the product, with only two to three weeks of supply left. The disruption, they said, is the fourth major one involving the drug within the past five years, and a “disruption to its availability has a major impact on patients.”

The disruption “will likely lead to supply issues for ophthalmology practices and lead to identifying other compounded sources or switching to alternative VEGF inhibitors, including Pavblu,” asserts Andy Szczotka, Pharm.D., chief pharmacy officer at AscellaHealth.

“Pavblu just adds another option to this category for patients in the event Avastin is unavailable,” agrees Renee Rayburg, R.Ph., vice president of specialty clinical consulting at Pharmaceutical Strategies Group (PSG), an EPIC company.

“Our organizations have significant concerns regarding patient access to repackaged Avastin and negative outcomes stemming from the abrupt discontinuation,” AAO and ASRS wrote in a letter to Meena Seshamani, M.D., Ph.D., CMS deputy administrator and director. “We ask that CMS notify all Medicare contractors, including traditional MACs and Medicare advantage plans, of this critical medication supply disruption and urge a halt to step therapy and prior authorization requirements for alternative ophthalmic anti-VEGF therapies to avoid treatment delays.”

While the FDA has approved five Avastin biosimilars, AAO and ASRS have warned against their use in ocular conditions.

Regeneron also has a higher dose formulation of Eylea known as Eylea HD that the FDA approved on Aug. 18, 2023. Eylea is available as a 2 mg formulation compared to Eylea HD’s 8 mg, which allows for longer periods of time between doses. It is approved for use in three of Eylea's five indications: neovascular (wet) age-related macular degeneration (AMD), diabetic macular edema (DME) and diabetic retinopathy (DR).

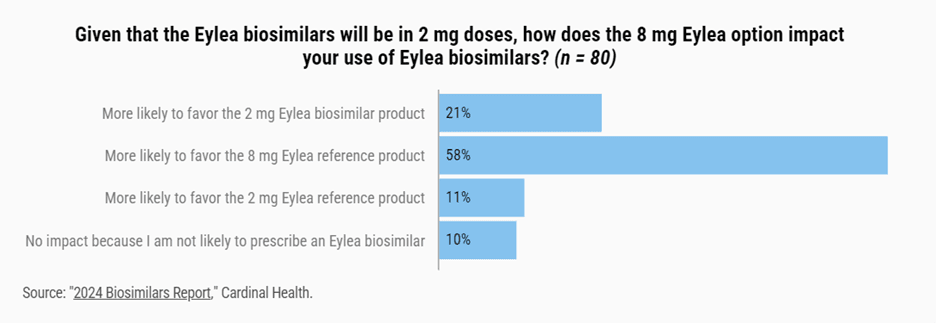

“This strategy aims to minimize market share loss to Eylea biosimilars once they fully enter the U.S. market,” notes Rayburg. A survey last year revealed that most retinal specialists are aware of the product and are somewhat likely to prescribe it. According to Cardinal Health’s 2024 Biosimilars Report, among 80 retinal specialists polled in November and December 2023, almost all were aware of Eylea HD, and a majority said they were at least somewhat likely to move their current patients on the lower-dose formulation to the 8 mg dose (see infographic).

However, it’s somewhat unclear how much uptake the newer formulation has gotten. “Regeneron reported U.S. sales of $392 million in the third quarter of this year, but I have not been able to identify a specific number of patients or percentage of patients who have transitioned,” says Rayburg. She points out that both formulations are competing with Genentech’s Vabysmo (faricimab-svoa), “with Vabysmo seeing an increase in market share growth as well.”

Szczotka point out that “the clinical studies demonstrated that the Eylea HD formulation administered every 12 or 16 weeks was noninferior as compared to Eylea administered every eight weeks,” he says. “The safety was consistent between the various formulations, however with a higher incidence of intraocular inflammation with Eylea HD, especially in the every-12-week group. It has been reported that the Eylea HD formulation has approximately 25% of the total Eylea sales in the third quarter of this year.”

In an Oct. 22 research note, Cantor Fitzgerald & Co. analyst Olivia Brayer said that Regeneron “tells us they have many levers that they could pull to accelerate converting patients to Eylea HD if a biosimilar did enter the market that would help mitigate risks (although they're still keeping their cards close to their chest).” Converting patients, she maintained, is a “top priority given how competitive Vabysmo is. And having a biosimilar on the market cuts down on the time REGN has to quickly convert patients to the 8mg (vs. the 2mg) before having multiple biosimilar entrants.”

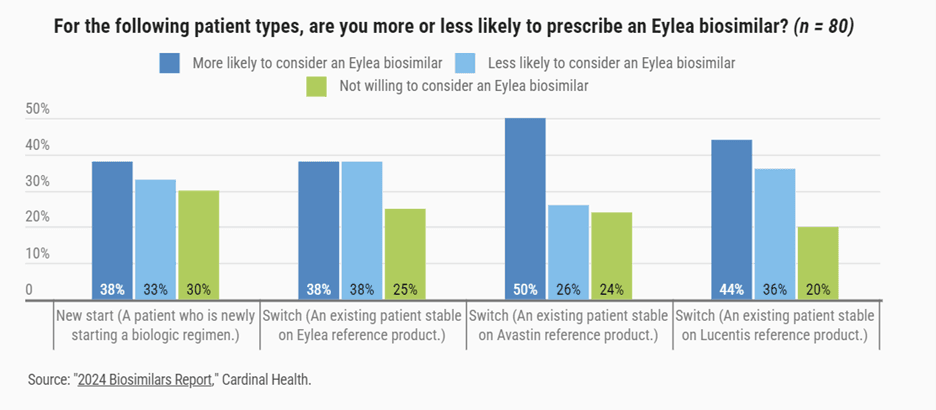

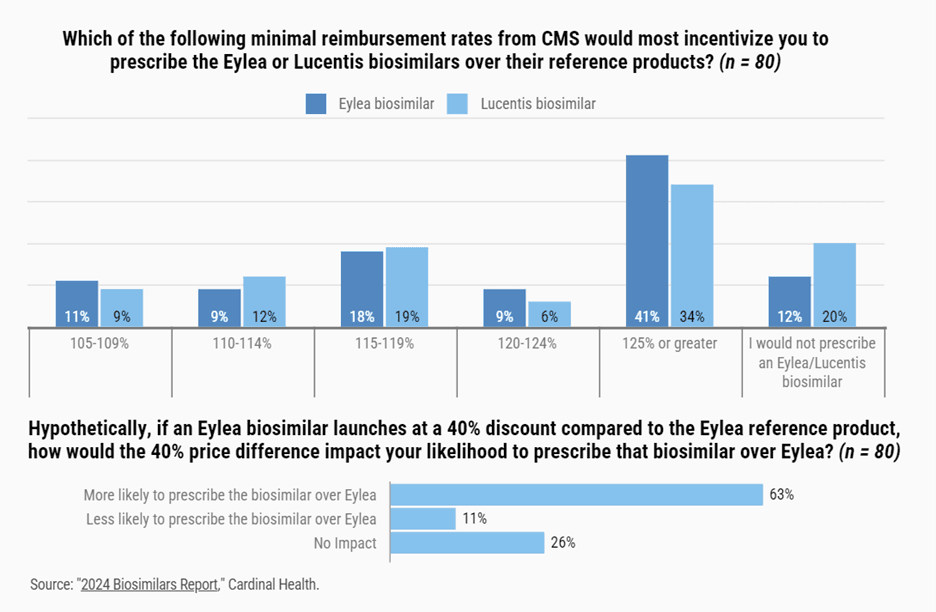

And according to the Cardinal Health report, retinal specialists are leaning toward prescribing those biosimilars. More than half of the respondents — 53% — said they were somewhat likely to consider using an Eylea biosimilar, and 26% said they were very likely to do so. They also gave feedback about which patients they would consider for such a biosimilar (see infographic), as well as financial incentives to use an Eylea biosimilar (see infographics).

By Angela Maas